How GenAI can turbocharge healthcare payers

Most health insurer activities are administrative or process oriented (levels 1-2), making them ripe for AI transformation

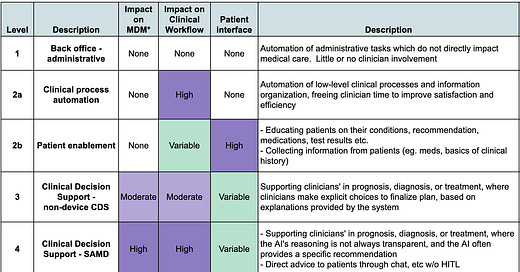

Every health insurer faces the fundamental challenge of making decisions based on massive amounts of complex, messy data at scale. Fortunately, that’s what GenAI does best. At the same time, insurers face unique regulatory and ethical constraints, requiring a judicious approach to minimize risks of harm and legal non-compliance. Getting GenAI right will be a defining competitive advantage for health plans over the coming decade - and the 5 Levels of Healthcare AI Automation can guide MCO leaders to a winning AI strategy.

Most payer AI solutions will be in Levels 1 and 2, with a smaller but significant set of care-related tools at Level 3. This article covers some of the highest potential opportunities across the key payer functions, and what it will take to implement them.

Member and Provider Services

Health insurance benefits are complex, and insurers spend substantial resources on call centers to clarify to members and providers what benefits are covered, deductibles, OOP-maximums, formulary tiers and other aspects of their plan. These touch-points are an opportunity help members navigate their health journey and steer them towards high-value, lower cost services, but only if the right information is easily available at the point of service. These Level 2 functions are currently fulfilled by a combination of online self-service tools and call center representatives, but the interactions tend to be slow and clunky. Doing this well requires integrating information across at least:

A member’s plan coverage

The payer’s policy documents

Their utilization to date

Up-to-date provider networks

The member’s current needs

This information is usually spread across silo-ed systems of record, in a way that’s difficult to aggregate or query manually. Custom data-integrations to answer specific questions are usually expensive and cumbersome to build, and struggle with inconsistent data formats across multiple legacy systems.

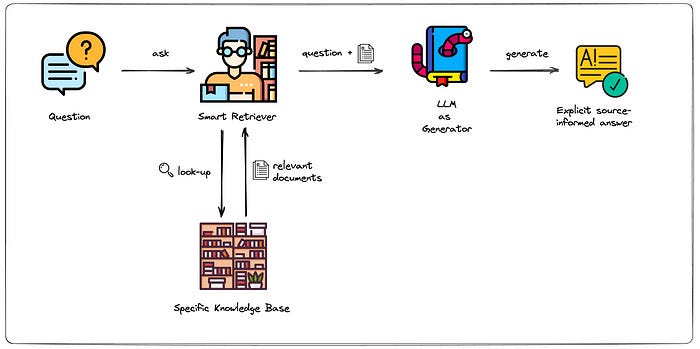

Large language models excel at bringing these sorts of data together easily - solutions such as Writer’s Knowledge Graph can link to a dynamic library of data sources, allowing an intuitive chat type-interface that can improve both rep productivity and customer satisfaction. Payers should focus first on developing GenAI based information access and member navigation tools for their own Member Services reps, and once the use cases are well-defined, further automate the tools to allow members to access them directly on the web or through an app.

Care Management and Coordination

These divisions of health insurers directly help members lead healthier lives and to navigate the complex healthcare system. Most insurers have a variety of Care Management programs (either as internal teams or outsourced vendors) who proactively reach out to members. The lightest touch interventions focus mainly on providing information, where higher-intensity teams actively coach patients or manage the interface between different providers. Doing this through traditional manual processes is extremely labor intensive, which a major reason why few care management programs show a substantial RoI. GenAI solutions can change this, by automating key processes around:

Content,

Context, and

Planning

Content

Much of the work of Care Management is in providing information to patients. However, this is only impactful if patients feel like the content is tailored to their specific situation, taking into account their medical, cultural, and social situation. GenAI solutions can create customized health content that would be impossible for case managers to do manually - a perfect Level 2b Patient Enablement task. To take the example of advising a 56 year old Hispanic female on Managed Medicaid with diabetes and hypertension who lives in Houston:

Traditional generic instructions: Eat less carbs and more vegetables

Personalized, GenAI supported instructions: Your last A1C was 9.0, which is putting you at risk for strokes and a heart attack! Try switching from white to whole wheat tortillas, and did you know there is a farmer’s market around the corner that accepts your SNAP benefits?

Which of these is the member more likely to listen to?

Context

Care coordinators particularly need to understand what’s going on with a member in order to guide what happens next. They spend much of their time digging through voluminous PDFs of medical records from disparate sources, difficult to parse utilization data, and details of member benefits. GenAI excels at summarizing these into a coherent snapshot - it’s the equivalent of adding an inconceivably fast medical assistant to each team, at a fraction of the cost. With this support care coordinators multiply their productivity and impact, delivering the sort of efficiency expected of a Level 2a - Clinical Process Automation interventions.

Planning

A good care plan

comprehensively assesses a patient’s needs, and

how they will be addressed, to

inform and coordinate all relevant stakeholders - patient, payer, and usually multiple providers.

Like the Content and Context generating activities, this sort of Planning requires integrating information from disparate sources, but also proscriptive helps guide care, making it a Level 3 intervention around Treatment Planning. Large Language Model (LLM) based GenAI solutions can draft care plans that incorporate all available information about a patient’s condition as well as the best practices in care planning with consistent high quality, and in a fraction of the time it would take a human being.

There has been substantial controversy in the past year around algorithms used for case management and coverage decisions - particularly by Cigna and United Healthcare. The algorithms in question were NOT AI based algorithms, but rather deterministic statistical models to predict variables like service eligibility and Length of Stay. More details will likely come out in the coming months, but the allegation does not seem to be that the algorithms were inaccurate or that there’s no role for computerized guidance. Rather, it seems that workflows were built around the algorithms which gave them too much credit - they were treated like highly validated Level 4 systems, where they are really Level 3 tools, which require substantial discretion from a Human In The Loop, especially when applied to populations different from the origination cohort.

Claims Processing, Utilization Management, and Prior Authorization

Insurers have been investing in automating these processes for years, but the advent of Generative AI will allow the next level of progress. New LLM technologies will deliver a number of major improvements, including:

Higher accuracy flagging claims for review

Automatically reading EHR charts which accompany UM cases or PA requests, and generating automated approvals, requests for more information/records, or escalation to a human reviewer with summarization

Automatically generating explanations for decisions rendered

GenAI solutions can base their recommendations on a combination of known best practices, as well as an up-to-date reference to new medical literature and clinical practice guidelines. As these technologies will initially be validated to no more than Level 3, they should be able to generate automated approvals, but cases they can’t approve need to be escalated to a human before issuing a denial.

Contested Prior Authorization requests are often escalated to a “Peer-to-Peer” review, where the ordering physician discusses the case with a physician who works at the insurance company. These are often time-consuming to schedule, and are often resolved with the sharing of relatively simple information that was missing in the initial documentation. Creating a “Peer-to-Bot” alternative, where applying clinicians can resolve these issues at their own convenience with zero hold time could obviate the need for many Peer-to-Peer reviews.

Compliance and Reporting

“Healthcare” and “Insurance” are separately among the most highly regulated aspects of modern society - making compliance and reporting critical functions for health insurers. The situation is compounded by the fact that government sponsored plans (Medicare Advantage/Managed Medicaid) are the highest growth segment for US MCOs.

Some of the compliance and regulatory functions for payers which could be automated by GenAIs are not specific to healthcare - the writing of SEC reports and other investor documentation, for example is ripe for LLM support. Other compliance and regulatory opportunities are more specific. With all of the attention currently focused around Risk Adjustment coding, a GenAI system could read medical records to assure that diagnoses are adequately supported by the documentation, protecting against RADV audits or worse. At a more macro level, many Managed Medicaid programs require frequent and specific reporting based on state-specific criteria - a cumbersome administrative tasks which could also be substantially automated.

Particular challenges and implementation implications

While the size and administrative complexity of the health insurance industry makes it uniquely suited to benefit from Generative AI solutions, it also has some particular challenges. Providing inaccurate information could have significant financial and health implications, so it is important that all systems:

Include adequate guardrails to protect against hallucinations

Allow tracing information provided back to original source documents

Go through a validation process to assure accuracy, and is regularly tested to make sure it’s performance is maintained over time

Have clearly defined use characteristics, where it is clear to all users the scope of the algorithm, and the role of the Human in the Loop (HITL) exercising judgement and discretion

Higher levels of automation require more rigorous validation process and better defined HITL roles, which will make them slower to deploy.

Much of the internal data is quite sensitive - whether it’s PHI, PII or commercially sensitive pricing or other information. And the data itself is complex - often spread across poorly compatible legacy systems with inconsistent formatting. While data wrangling usually takes up 80-90% of the effort in any AI project, the complexity is particularly challenging for payers.

Many firms, including UnitedHealth and Cigna, have established AI Centers of Excellence to govern, manage and coordinate AI efforts across the enterprise. As we are all in a learning phase today, most are experimenting with multiple platforms, be they self-hosted LLaMAs, Google’s MedPaLM2, or Writer’s Palmyra Med. However, the information security and ELT challenges associated with each new data vendor are immense. Companies will have to iterate their way to taking positions on a few key strategic platforming questions, including:

Even with a BAA in place and SOC2 security, are they comfortable with having large volumes of sensitive data transmitted to partners, especially those with a questionable history of keeping their data-security promises? (e.g. Google, OpenAI)

It it worth the overhead costs of onboarding a large number of point-solutions, which may have very specific best-in-breed products, or stick with a smaller number of “platform” vendors, who can fill an expanding set of needs as they get to know your data and organization?

How will organizations assess the potential risks and benefits of AI-based solutions, and determine the precise level of validation required to implement (our biased plug - using the 5-Level Healthcare AI Automation framework)

It’s too early to know if there is a universal “right” answer to any of these questions, but thoughtful payers are already dedicating resources to actively engage with them.

Summary

This article has barely scratched the surface of the opportunities for Generative AI for Health Insurers. There are other functions, such as provider credentialing, generation of plan documents, responding to government RFPs and generating marketing materials where GenAI support could 10x the efficiency and productivity, leading to a better member experience, better health outcomes, happier staff and improved financial performance (the health insurance version of the Quadruple Aim). However, we believe that the highest impact near-term solutions will be in the areas of :

Member and Provider Services

Care Management & Coordination

Claims Processing, Utilization Management, and Prior Authorization

Compliance and Reporting

There are enormous opportunities for efficiency and improved performance across the first 3 levels of automation in all of these categories, and payers should be organizing themselves to address the highest RoI/lowest risk opportunities immediately, while planning out a longer-term GenAI transformation roadmap.